Headline inflation may have come down over the past year, but consumers’ expectations about future inflation have not. In fact, five-year expected inflation has been inching up rather than down in recent months, according to the University of Michigan consumer survey.

The median expectation is that inflation will run at a 3.1% annualized pace over the next five years; you have to go back to 2008 to find a higher reading. The mean expectation, which skews higher, is the highest it’s been since the mid-1990s.

Such expectations are a source of worry to many, on the theory that they are self-fulfilling: If consumers expect high inflation, the argument goes, they will behave in ways that accelerate the pace of inflation. If the U.S. Federal Reserve at its mid-June meeting decides to hike interest rates rather than hit the “pause” button, one of the big culprits may be consumers’ stubbornly-high inflation expectations.

The historical support for this theory is surprisingly weak, however. More often than not over the past several decades, consumers’ inflation expectations were a contrarian indicator, with subsequent five-year inflation below average when expectations were above average, and vice versa.

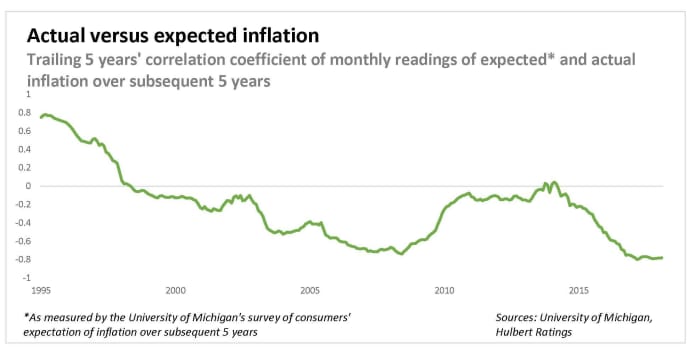

This inverse relationship is illustrated in the chart above. For each month, I compared actual inflation over the subsequent five years with what consumers were expecting at the beginning of that five-year period. The chart plots the correlation coefficient for the trailing 60 months. Positive readings indicate that expected and actual inflation moved up and down in synch with each other over the trailing five years, while negative readings indicate that the two moved inversely.

Notice that the last time the correlation coefficient was significantly positive was the mid-1990s. Since then it has been almost universally negative, and has reached its most negative reading over the most recent five-year period. While it would be going too far to conclude from this that we (or the Fed) should celebrate consumers’ stubbornly-high inflation expectations, these results at a minimum suggest that they shouldn’t necessarily be taken at face value.

Which inflation model has the best record?

If consumer expectations don’t do a good job forecasting inflation, does anything have a better record predicting inflation over the subsequent five years? I tested several other models, including:

- The 5-year breakeven inflation rate (the difference between the yields on nominal 5-year Treasurys and the 5-year TIPS)

- The short- and long-term inflation projections from the Survey of Professional Forecasters conducted quarterly by the Philadelphia Federal Reserve

- The inflation expectations model maintained by the Cleveland Federal Reserve

I tested each of these since 2003, which is the earliest year for which data are available for all three models. The only one with a statistically significant correlation was the Cleveland Fed model.

Its current projection is that inflation over the next five years will run at a 2.2% annualized pace. That may be close enough to the Fed’s stated inflation target of 2% to enable central bankers to not raise rates at its June meeting.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: The Federal Reserve is stuck in a deep hole — and it has only itself to blame

Plus: Pausing rate hikes would saddle Americans with much higher inflation than the Fed’s 2% target