Is it time for a millionaire money makeover?

This past year has clearly been tough on investors — from clock-watchers to high-net-worth individuals — and the latter have shown a dramatic change in behavior. Falling stock prices, rising interest rates, an uncertain economic outlook and the constant drumbeat of recession have led high-net-worth individuals (HNWIs) to change their investing habits: they’re keeping their money in cash and cash equivalents at the highest rate in more than a decade.

The rise in interest rates over the past 12-18 months was the fastest Federal Reserve tightening on record, after a very long decline over a 30-year period where the 10-year decline from 15% in 1981 to under 1% in 2021, Paul Karger, co-founder and managing partner of TwinFocus, a wealth advisory firm, told MarketWatch.

“After rates hovering around zero for so long, this finally created an opportunity for savers to earn a yield on their cash, whereby effectively the banks are now competing with Uncle Sam for deposit,” he said. “As it stands today, the 6-month T-bill is the highest on the yield curve, paying about 5.45% while the 10-year is paying roughly 3.71%.”

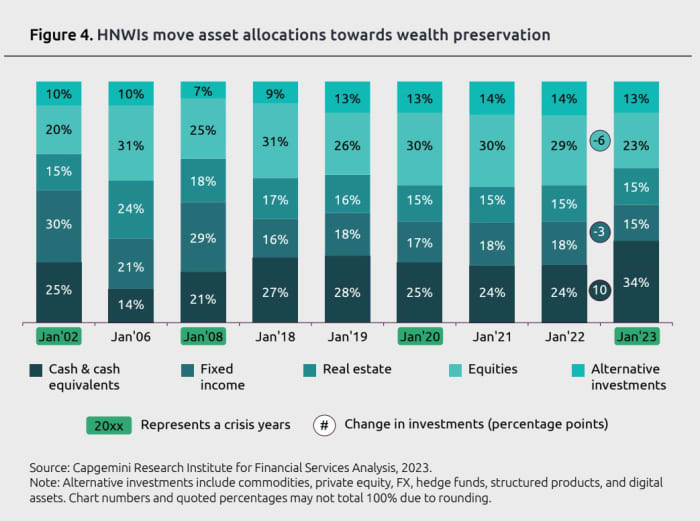

“High-net-worth individuals stored 34% of their wealth in cash and cash equivalents in 2022, up 10 percentage points on 2021.”

The Capgemini Research Institute, a global think tank, has more detail on a privileged group of investors. It tracks the behavior of HNWIs, and analyzes the asset allocation from the most conservative investor to the most aggressive. In its latest annual report, the number of the world’s HNWIs has fallen to 21.7 million in 2022 from 22.5 million in 2021, largely due to a fall in stock prices, the latest report found. (Other sources have higher estimates for the world’s HNWI population.)

Here’s a breakdown of the numbers: HNWIs stored 34% of their wealth in cash and cash equivalents in 2022, up 10 percentage points from 24% during the prior year, according to Capgemini’s annual wealth report, which was released this month. It’s also 20 percentage points lower than the 14% stored in cash and cash equivalents in 2006, a couple of years before the Great Recession. What’s more, cash is expected to remain high — along with interest rates.

“We’ve never seen this before — banks are sitting on tons of cash, sitting idle, waiting for the right opportunity,” Elias Ghanem, global head of Capgemini Research Institute for financial services, told MarketWatch. “The amount of money held in cash has never been so high, and the jump year-over-year has never been so high. They’re putting their money into short-term cash allocation, checking accounts, savings accounts, and CDs.”

High-net-worth individuals are keeping their money in cash and cash equivalents at the highest rate in more than a decade.

MarketWatch illustration/iStockphoto

Holding off on investing in equities

Nearly 70% of HNWIs cited “wealth preservation” as their No. 1 focus. “I’ve been presenting this report to banks across the globe,” Ghanem said. “All of them are confirming what I’ve told you.”

These habits appear to be reflected by retail investors who don’t have millions of dollars to invest (or burn). “Some of our clients are hesitant to invest cash in this environment and, more often than I can remember in the last few decades, are asking for T-bill and CD ladders while they wait,” Lorraine Ell, chief executive and senior financial adviser of Better Money Decisions, a financial advisory firm near Albuquerque, N.M.

“We don’t recommend waiting, but this is a time when clients are requesting to hold off investing in equities, probably a result of high interest rates for holding cash and cash equivalents and uncertainty about interest rates and recession and their impact on markets,” she added. Flows into exchange-traded funds this year have gone into defensive equities and bonds — and not more aggressive equities, she added.

“Flows into exchange-traded funds this year have gone into defensive equities and bonds — and not more aggressive equities.”

Indeed, total ETF flows so far this year suggest “investors’ diminished appetite for risk,” a June report by State Street Global Advisors concluded. ETFs took in $44 billion in May, in line with the 5-year average of $44 billion, but below the 3-year average of $54 billion. “But only 47% of ETFs had inflows — 15 percentage points below the historical median,” it said. “Equities were 17 percentage points below their historical median (44% versus 61%).”

Given the economic backdrop and how many Americans are living paycheck to paycheck, there is one big problem for those who would like to stash their cash: they don’t have the cash to begin with. In fact, only 48% of U.S. adults say they have enough emergency savings to cover at least three months’ worth of expenses, a recent Bankrate survey found. That percentage has remained virtually unchanged since it was 49% in 2022 and when inflation was at a 40-year high.

High-net-worth individuals stored 34% of their wealth in cash and cash equivalents in 2022, up 10 percentage points from 24% during the prior year.

Source: Capgemini Research Institute

Wealthy individuals, on the other hand, are especially well-placed to take advantage of high interest rates. “High-net-worth individuals and family offices tend to hold greater cash balances than most for a few reasons — primarily for operating needs of their lives and their businesses,” Karger said. “They also tend to have much higher allocations towards alternative investments, which often require cash funding over time.”

And for those who do have money to invest? The year got off to a promising start with a stock-market rally, but it recently appeared to run out of steam. The S&P 500

SPX,

has rallied more than 14% so far in 2023 and is up nearly 15% over the last 12 months. The rally has been concentrated, however, in megacap tech stocks, leaving much of the market behind. An equal-weight measure of the S&P 500 is up just 4.4% so far this year and 8.8% over the last 12 months, according to FactSet.

“We don’t think the rally is over, but it may be difficult” for that earlier rally to continue in the weeks ahead “with liquidity coming out of the system,” Michael Arone, managing director of State Street Global Advisors, told MarketWatch in a phone interview earlier this week. So much for FOMO — “fear of missing out” — by those investors sitting on the sidelines.

Global stocks reported their worst performance since the 2008 financial crisis with nearly $18 trillion wiped out in 2022, the Capgemini report said. Only 23% of their investible wealth was held in equities, down 6 percentage points from 29% in 2021. Real estate appeared to be another relatively safe haven with a 15% allocation, a percentage that has not changed since 2020. Ditto alternative investments, which hovered at 13% to 14% for the last four years.

Searching for a middle ground

While understandable, the move to cash has been costly to many this year. Money market investors have likely earned 2%-2.5% year-to-date, and have totally missed out on a 15% rally in equities, said Tim Urbanowicz, head of research and investment strategy at Innovator ETFs. “This is one of the reasons we have been big advocates for being risk aware, and not risk off,” he added.

Andrew Schuler, investment managing director at PNC Private Bank, agrees. “When cash was yielding zero, purely from an investment perspective, clients had little incentive to hold cash,” he said. “Now, given recession fears and the substantial rise in rates, many clients are more comfortable holding cash yielding around 5% instead of taking risks in the markets.”

But he too said that the cautionary approach comes with a downside. “We do tell our clients that the risk you don’t see is the loss of purchasing power,” he added. “When inflation is running 4%-5%, your real yield is close to breaking even. This is unlikely to achieve the investment results the clients’ longer-term goals and objectives require.”

“‘We do tell our clients that the risk you don’t see is the loss of purchasing power.’”

“It doesn’t have to be all-or-nothing decisions,” Schuler said. “Sure, you can hold a higher cash reserve, but that doesn’t mean you should be all cash or all invested — there is a middle ground using higher yields to your advantage as part of your asset allocation. We always recommend that clients maintain sufficient cash to satisfy current lifestyle needs and other known expenses.”

Capgemini, meanwhile, considers high-net-worth individuals anyone with investible assets of $1 million and above, excluding their primary residence, and divides these HNWIs into several categories: “millionaires next door” with $1 million to $5 million in investible assets, mid-tier millionaires with $5 million to $30 million, ultra-HNWIs with $30 million or more. Their net worth fell to $83 trillion at the end of 2022 from $86 trillion in 2021, Capgemini’s report found.

Some regions were hit harder than others. “Difficult macroeconomic conditions led to bearish global markets and significant declines in indices across regions. Following suit, globally, high-net-worth wealth and population totals dropped by 3.6% and 3.3%, respectively, as compared to the prior year,” the report added. “While still the wealth leader, North America registered 2022’s steepest declines, with total high-net-worth wealth falling by 7.4% and population by 6.9%.”

Many cash investors are looking at 5%-plus interest rates. “This is where people are today,” Ghanem said. “High-net-worth individuals are taking a wait-and-see approach, ready to make the next investment when the right opportunity presents itself.” But he remains optimistic about equities in the long term. “Everyone is saying, ‘Something positive will happen, and I want to be able to act fast on it,’” he added. “They’re saving their assets to do the job.”