An upstart Managed Options Trading Account established in 2017 by Agency Desk, LLC’s stock market guru Darren Harris has skyrocketed 17,700% since they started taking on clients.

We’ve been tracking some of the trades done by Harris this year, and his big play was to spot how deadly the corona virus would be, pushing stock markets lower around the world.

Buying put options on the Dow Jones Index, which increases in value as the market falls, pushed the profits for the account to over 170% to start the year.

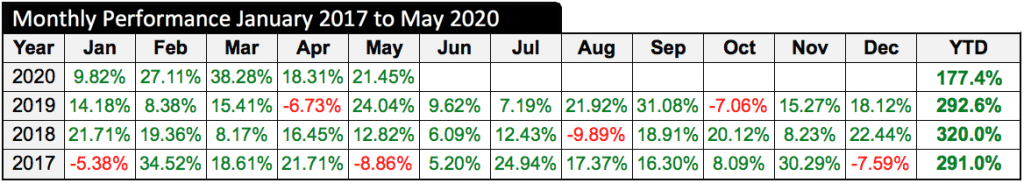

This year’s trading results are not a fluke. The Options Account started in January 2017, showed profits before fees of:

- 290% in 2017

- 300% in 2018

- 292% in 2019

Read the full article...

Sign up for more information about this Managed Options Account

*Your information is kept confidential and will not be shared with any third party.

Darren Harris agreed for me to publish part of the conversation we had when I called to interview him. Here are some of the interesting points :

What is the minimum investment?

“Options trading is a little riskier than buying stocks, so we advise our clients to put a small percentage of their portfolio into this. Many first time investors start with $10,000 to $20,000 USD, but our minimum to open an account is only $2,000 USD, which is more realistic if you don’t have a large enough investment portfolio. Even in this account, you still get to copy the exact same trades we do for our own company account.”

Have any of your clients ever lost money?

“Some clients have been down around 10% on paper, but as long as they stick with us for 3 months, we have never had a client lose money.”

Why is your trading so successful?

“Our chief trading team has over 60 years of experience in trading options, so we have a good idea of how the market will react to certain news. Our strategies can make money whether the stock goes up or down, which gives us a huge advantage over just buying and selling traditional stocks. And with arbitrage, there are some opportunities that are guaranteed to make money, so we look for those situations as well.”

Do you trade manually, or use robots?

“Most of our trades are done manually, but we have several automated trading systems that track opportunities through algorithms, using technical indicators to alert us before we make a trade. These systems have been fine-tuned over the years, and are generating continuous trading signals which are converted into winning trades.”

show less

For more information on the Fund, you can contact Agency Desk directly at trading@agencydeskllc.com