Oil prices set another 2023 high this week as concerns about a tightening market pushed the Brent benchmark crude close to $100 a barrel, complicating the Federal Reserve’s effort to bring down inflation ahead of the September policy meeting and raising fears that a U.S. recession might be still on the horizon.

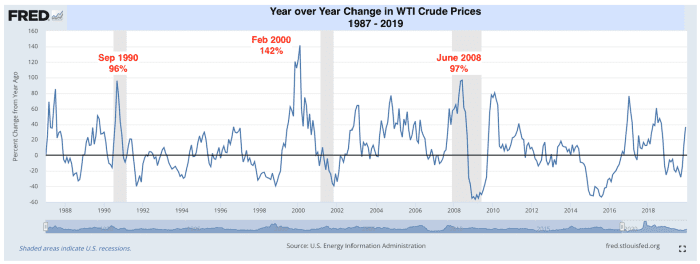

History shows that surging energy costs usually play a role in tipping the U.S. into recession. When oil prices doubled in September 1990, February 2000, and June 2008, the economy was either in a recession or would shortly be in one, said Nicholas Colas, co-founder of DataTrek Research, in a Tuesday note (see chart below).

SOURCE: U.S. ENERGY INFORMATION ADMINISTRATION

“Oil price spikes matter much more than modestly rising prices. Household income is fairly fixed in the near term, so spiking oil or gasoline prices force them to quickly cut back on other spending categories,” Colas said. “The greater the increase, the more likely a recession eventually unfolds.”

But this time, Colas is not certain if the same dynamic will still play out. For example, the U.S. benchmark West Texas Intermediate crude

CL00,

CL.1,

trended around $70 per barrel in May and June, so it would therefore take a move to $140 per barrel to trigger a potential recession. However, the most recent high for WTI was $123 per barrel in March 2022 after Russia’s invasion of Ukraine, so investors “have to see higher oil prices than last year’s geopolitical conflict to get a recession-inducing double over the next 12 months,” Colas said.

On Tuesday, the West Texas Intermediate crude for October delivery

CLV23,

fell 28 cents, or 0.3%, to settle at $91.20 per barrel on the New York Mercantile Exchange after finishing at $91.48 in the previous session, the highest front-month contract finish since Nov. 7, according to Dow Jones Market Data. November Brent crude

BRN00,

BRNX23,

the global benchmark, edged down 0.1%, to settle at $94.34 a barrel on Tuesday after a high of $95.96 on ICE Futures Europe.

“History says we are nowhere near having to worry about rising oil prices tipping the U.S. economy into a recession,” Colas said. “Now, if WTI rapidly rises to over $100 per barrel and seems set to move swiftly higher, then capital markets may start to pay attention.”

One of Wall Street’s most bearish oil analysts, Edward Morse, global head of commodity research at Citigroup, said that Brent could surpass $100 a barrel “for a short while” amid mounting worries over a supply shortage following recent output cuts by Saudi Arabia and Russia, which have been extended until the end of this year, as well as geopolitical tensions. However, he said the uptick in oil prices will likely retreat next year.

“The Saudi appetite to withhold oil from market, supported by Russia maintaining a certain level of export constraint, points to higher prices in the short term, all else equal, but $90 prices look unsustainable given faster supply growth than demand growth ex-Saudi/Russia,” Morse said in a Monday note. “Higher prices in the near term could make for more downside for prices next year.”

See:Consumers take notice as inflation bites and oil prices top $90 a barrel

The drop in oil prices played a vital role in cooling U.S. inflation in the first half of 2023, but investors fear the recent surge in oil prices will act as a brake as the Federal Reserve is nearing the end of its interest-rate hiking campaign.

Neil Shearing, group chief economist at Capital Economics, said the idea that higher oil prices are an inflationary threat in advanced economies is “easy to overstate.”

If Brent crude prices stay at their current level of around $95 per barrel through the end of the year, energy will actually be “a drag” on headline inflation in developed markets, Shearing said. “Things get more complicated by early 2024, when oil is likely to make a positive contribution to headline inflation. But this is likely to be overwhelmed by other disinflationary forces.”

See: 4 things to watch for at this week’s Fed monetary-policy meeting

U.S. stocks finished lower on Tuesday as investors awaited the Federal Reserve’s interest-rate decision on Wednesday afternoon. The S&P 500

SPX

ended 0.2% lower, while the Dow Jones Industrial Average

DJIA

was off 0.3% and the Nasdaq Composite

COMP

dropped 0.2%.