Oil traders on Sunday said crude prices were likely to remain supported in the near term, as investors assessed the fallout from the surprise attack by Hamas on Israel and focused on the role played by Iran and the potential impact on that country’s petroleum exports.

The conflict may also hold market-moving consequences for talks aimed at normalizing relations between Saudi Arabia and Israel.

“While in the short term there is no impact directly on supply, it’s obvious how things play out over the next 24 to 48 hours could change that,” Phil Flynn, an analyst at Price Futures Group in Chicago, told MarketWatch.

Brent crude futures

BRN00,

the global benchmark, and West Texas Intermediate oil futures

CL00,

CL.1,

jumped more than 3% when the market opened Sunday night. U.S. stock-index futures

ES00,

traded lower, while traditional havens, including gold

GC00,

and the U.S. dollar

DXY

rose.

Movements in oil prices, meanwhile, will also serve as a gauge for broader market worries around the conflict, analysts said.

See: Israeli stocks slump in first day of trade since Gaza attack

Hamas, the Iran-backed, Palestinian militant group that controls the Gaza Strip, staged a sweeping attack on southern Israel early Saturday. News reports put Israeli deaths at more than 700. The Gaza Health Ministry said 413 people, including 78 children and 41 women, were killed in the territory as Israel retaliated, according to the Associated Press. Injuries in Israel and Gaza were both said to be around 2,000.

Israeli troops on Sunday were engaged in fierce fighting in an effort to retake territory in southern Israel as Hamas launched further barrages of missiles. Israeli citizens and soldiers were captured and are being held hostage in Gaza, according to the Israeli military.

Read: Israel declares war, approves ‘significant’ steps to retaliate after surprise attack by Hamas

The Wall Street Journal reported that Iranian security officials helped Hamas plan the attack. U.S. officials said they haven’t seen evidence of Iran’s involvement, the report said.

“Iran remains a very big wild card and we will be watching how strongly [Israeli] Prime Minister Netanyahu blames Tehran for facilitating these attacks by providing Hamas with weapons and logistical support,” said Helima Croft, head of global commodity strategy at RBC Capital Markets, in a Sunday morning note.

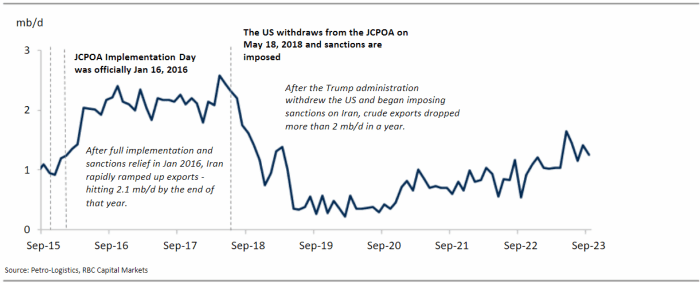

Iranian crude exports have risen in recent years, indicating the Biden administration has adopted a soft approach to sanctions enforcement, Croft said. Some analysts have put Iranian crude production at more than 3 million barrels a day and exports above 2 million barrels a day — the highest levels since the Trump administration pulled the U.S. out of the Iranian nuclear accord in 2018, according to the Wall Street Journal. Sales fell to around 400,000 barrels a day in 2020 as the U.S. reimposed sanctions.

RBC Capital Markets

Hedge-fund manager Pierre Andurand, one of the world’s best energy traders, said in a social-media post that a large price spike for oil isn’t likely in coming days, but emphasized the market focus on Iran.

“Now, over the last six months we have seen a very large increase in Iranian supply due to weak enforcement of sanctions. As Iran is also behind Hamas’ attacks on Israel, there is a good probability that the U.S. administration will start enforcing those sanctions on Iranian oil exports more tightly,” he wrote. “That would further tighten the oil market. Also the probability that this will lead to direct conflict with Iran is not zero.”

Meanwhile, the Wall Street Journal late Friday reported that Saudi Arabia had told the White House it would be willing to boost oil production next year if crude prices remained high, as part of an effort aimed at winning goodwill in Congress for a deal that would see the kingdom recognize Israel and in return get a defense agreement with the U.S.

A Saudi production cut of 1 million barrels a day that was implemented in July and recently extended through the end of the year has been given much of the credit for a rally that took global benchmark Brent crude within a few dollars of the $100-a-barrel threshold before retreating this past week. The U.S. benchmark last week briefly topped $95 a barrel for the first time in 13 months.

In a statement, Saudi Arabia’s foreign ministry called on both sides to halt the escalation and exercise restraint, but also recalled its “repeated warnings of the dangers of the explosion of the situation as a result of the continued occupation, the deprivation of the Palestinian people of their legitimate rights, and the repetition of systematic provocations against its sanctities.”

With the Israeli government vowing an unprecedented response, “it is hard to envision how Saudi normalization talks can run on a parallel track to a ferocious military counteroffensive,” said RBC’s Croft.

Beyond oil, much will depend on the potential for the conflict to widen.

Stocks have stumbled, retreating from 2023 highs set in late July, as yields on U.S. Treasurys have jumped. The yield on the 30-year Treasury bond BX:TMUBMUSD30Y rose 23.2 basis points last week to end Friday at 4.941%, its highest since Sept. 20, 2007. The 10-year Treasury note yield BX:TMUBMUSD10Y topped 4.80% on Oct. 3, its highest since Aug. 8, 2007, and ended the week at 4.783%. Yields and debt prices move opposite each other.

The U.S. bond market will be closed Monday for the Columbus Day and Indigenous People’s Day holiday, while U.S. stock markets will be open.

The S&P 500 index SPX rose 0.5% last week, breaking a streak of four straight weekly declines, while the Dow Jones Industrial Average DJIA fell 0.3% and the Nasdaq Composite COMP gained 1.6%.

“I think there will be a negative reaction. However, I don’t see a meltdown,” Peter Cardillo, chief market economist at Spartan Capital Securities, told MarketWatch.

Traditional haven plays, including gold, the dollar and U.S. Treasurys may see a strong move upward, with price gains for Treasurys pulling yields down.

“Geopolitical crises in the Middle East have usually caused oil prices to rise and stock prices to fall,” said economist Ed Yardeni, president of Yardeni Research Inc., in a note. “More often than not, they’ve also tended to be buying opportunities in the stock market.”

The broader market reaction will depend on whether the crisis turns out to be a short-term flare-up or “something much bigger, like a war between Israel and Iran,” he said. The latter is unlikely, but tensions between the two are likely to escalate.

“The price of oil may be a good way to assess the likelihood of a broader conflict,” he said.