By now, more than 60 million Medicare beneficiaries are in the thick of Medicare’s annual election period, which runs from Oct. 15 through Dec. 7.

During this period, beneficiaries can modify their Medicare health or drug coverage for the coming year.

They will have received their annual notice of change and evidence of coverage documents, and might even have read through Medicare & You 2024, the official U.S. government 130-page handbook, and used Medicare’s Plan Compare tool to search for a Medicare plan that meets their needs.

But even if they’ve done all that, selecting the best plan can be an overwhelming task. So for Medicare beneficiaries who need help during the annual election period there are at least six places to turn.

Read: What to Know about the Medicare Open Enrollment Period and Medicare Coverage Options.

- Medicare

During Medicare’s annual election period, people can call Medicare directly 24 hours a day, seven days a week, at 1-800-633-4227 to receive assistance in comparing Medicare Advantage, Part D, and Medigap plans. The representatives at Medicare can help answer questions about coverage, claims, payments, and more, in both English and Spanish as well as language support in over 200 additional languages.

Beneficiaries can also use Medicare’s Plan Compare, which allows people to compare options for health and drug coverage. Medicare’s Plan Compare tool has been updated with the 2024 Medicare health and prescription drug plan information, according to a CMS spokesperson.

Low-income seniors and adults with disabilities may qualify to receive financial assistance from the Medicare Savings Programs (MSPs). The MSPs are essential to help millions of Americans access high-quality healthcare at a reduced cost, if people meet the conditions of eligibility. Enrolling in an MSP offers relief from these Medicare costs, allowing people to spend that money on other necessities like food, housing, or transportation. Individuals interested in learning more can visit Medicare Savings Programs.

In addition, a CMS spokesperson said the Low-Income Subsidy Program, also called Extra Help, is a Medicare program that helps qualifying individuals pay Part D premiums, deductibles, coinsurance, and other costs. In 2024, this program is expanding thanks to the Inflation Reduction Act, allowing all eligible enrollees to benefit from no deductible, no premium, and fixed lower copayments for certain medications. Enrollees can save nearly $300 per year, on average. Up to three million seniors and people with disabilities could benefit from the Extra Help program now but aren’t currently enrolled. Individuals who enroll in MSPs automatically qualify for help affording their prescription drugs through the Extra Help program. To learn more about the Low-Income Subsidy Program, visit: Medicare.gov.

Additional resources:Centers for Medicare & Medicaid Services (CMS), Medicare.gov and Medicare & You Handbook.

Pros of calling Medicare during the annual election period

Personalized interaction: According to Katy Votava, president of Goodcare.com, an independent consulting firm that provides advice on health insurance and Medicare coverage options and author of “Making the Most of Medicare: A Guide for Baby Boomers,” one of the primary benefits of calling Medicare during this period is the opportunity to speak with real people.

Medicare representatives can advise beneficiaries on what the most suitable plan is if “you’re willing to organize yourself and take the time to work with them,” Votava said.

Beneficiaries still need to enroll in the plan, according to Theresa Cangemi, president of Retirement Health Plans Made Simple, an independent Medicare insurance agent.

Customized medication plan search: Medicare representatives can conduct a tailored search for a medication plan that best suits your needs, according to Votava.

Assistance for caregivers: Caregivers can also reach out to Medicare on behalf of beneficiaries. However, the beneficiary must be present to authorize the conversation, unless prior authorizations are already in place with Medicare, said Votava.

Preparation tip: To make the most of your call, Votava recommends making sure all relevant information is organized and readily available.

Cons of calling Medicare during the annual election period

Potential wait times: There might be a wait time due to high call volumes. “Beneficiaries could find themselves on hold for extended periods,” said Votava. To minimize wait times, she recommends calling midweek. Mondays and Fridays tend to be the busiest days, she said.

Besides being difficult to get through, you might get different answers from different representatives, said Scott Maibor, a Medicare relationship manager with Senior Benefits Boston, a firm that provides Medicare consultations and education.

Knowledge: Maibor also said Medicare representatives should be a knowledgeable source for all Medicare questions, but they do not go into details about a carrier’s offerings beyond what the website shows as the least expensive medication cost.

Overwhelming: “Because the array of Medicare coverage options is completely overwhelming to the average consumer, attempting to ‘self-navigate’ by using Medicare.gov or calling 1-800-Medicare is not realistic for coverage comparisons,” said Tom Wright, the president of The Turning 65 Workshop, a firm that provides training, seminars, and workshops focused on educating older employees and HR professionals on Social Security and Medicare. He did note, however, that Medicare.gov is useful for comparing Part D prescription drug options.

2. State Health Insurance Assistance Programs (SHIPs)

The State Health Insurance Assistance Programs (SHIPs), which are federally funded by the U.S. Administration for Community Living, provide local and objective counseling and assistance to Medicare-eligible individuals, their families, and caregivers. In some states, such as Massachusetts and Florida, the counseling service is referred to as the SHINE Program (Serving the Health Insurance Needs of Everyone).

During Medicare’s enrollment period you can contact your SHIP or SHINE for one-on-one assistance with reviewing health or prescription drug plan options. Among other things, SHIP and SHINE counselors, who go through extensive training, can explain how Medicare works with supplemental policies, retiree coverage, Medicaid, and other insurers.

You can use the SHIP Locator to locate a counselor near you or call 1-877-839-2675.

Read: SHIP Overview Flyer.

Also read this Medicare blog about SHIPs and open enrollment

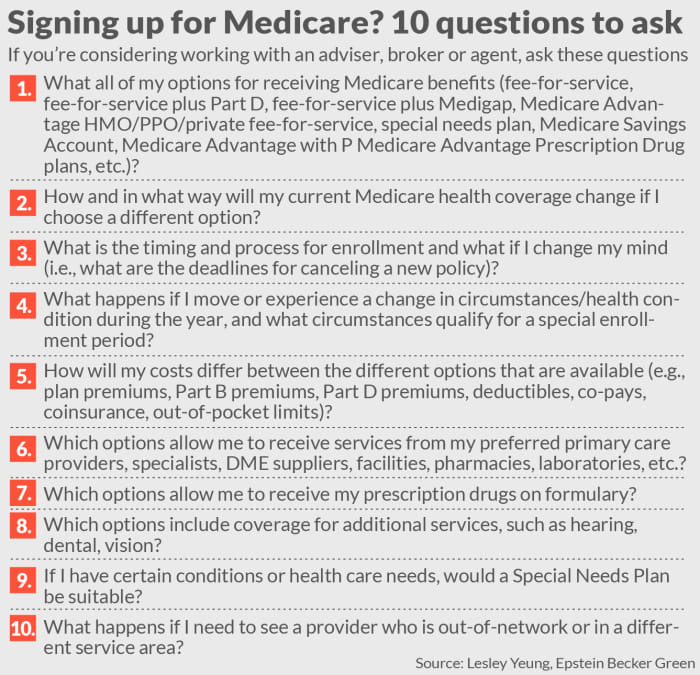

Read: Medicare handout with questions to ask when signing up for Medicare or Medicare Advantage

Pros of using SHIPs

Well-trained and free: The SHIP and SHINE counselors are independent and well trained. Plus, their services are free and available at most senior centers. SHIP and SHINE counselors can also provide information and referral for other needed services.

SHIP and SHINE counselors help beneficiaries with qualifying for government programs, Cangemi said, and may help with filling out applications for extra help such as the Low-Income Subsidy program, Medicaid, and the Medicare Savings Program.

Cons of using SHIPs

Limited availability: The big drawback is that volunteers have limited availability, according to Maibor. Often, volunteers are booked solid Monday through Friday from the moment a senior center opens till it closes. And given that, Maibor said it might be difficult to book another appointment if you need additional information.

Not getting enrolled: Typically, a SHIP or SHINE counselor would not enroll a Medicare beneficiary into a Medicare insurance plan. “They might just suggest or give (the beneficiary) printouts to the different Medicare options,” Cangemi said.

Competency might vary: These programs serve an important role; however, many rely on volunteers. “The caution I would offer is that this evaluation process is highly complex and that the level of a volunteer competency and experience varies greatly,” said Wright.

Tip: Votava recommends signing up as early as possible to schedule an appointment with a SHIP counselor.

3. Fee-for-service advisers

Fee-for-service Medicare advisers typically review the various Medicare options for beneficiaries including traditional Medicare, Medicare Advantage, Part D prescription plans, and Medigap supplemental plans and provide unbiased advice about the best plan to select.

Fee-for-service Medicare advisers are not affiliated with any specific insurance company or plan and they typically charge a flat fee or hourly rate for their services rather than earning commissions by enrolling beneficiaries into specific plans. Experts say the fee-based model reduces conflicts of interest and incentives to steer beneficiaries towards certain plans.

Pros of using fee-for-service advisers

Independent: Such advisers are “truly independent,” said Maibor. “They are able to act as a fiduciary with the best interest of the client at forefront,” he said. “And they can be a year-round resource.”

Cons of using fee-for-service advisers

Cost: The big drawback to using a fee-for-service adviser is cost, according to Maibor.

Cangemi shares that opinion. “A fee adviser would not be allowed to enroll a Medicare beneficiary into a Medicare plan,” she said. “After all that work, they could only show or discuss options. They advise only.”

According to Maibor, beneficiaries who do use a fee-for-service adviser will find that pricing will vary widely. In his practice, for instance, he currently charges a flat fee of $395 for new-to-Medicare beneficiaries and $195 for a review with a guarantee. A colleague in Chicago, by contrast, charges $1,495 for a consultation and another colleague charges $200 per hour.

Scarcity and quality: Experts also note that it’s hard to determine just how many qualified and competent fee-for-service Medicare advisers there are in the U.S. There is no official Medicare certification program specifically for fee-for-service Medicare advisers nor is there an official national directory of fee-for-service Medicare advisers.

Plus, Maibor says the actual number of fee-for-service model Medicare advisers is an “extremely small number. “Finding one I think is somewhat tricky,” said Maibor. “Google will mostly get you a list of brokers and it will be time consuming to distinguish between the two. The brokers typically highlight that their expertise is free to the beneficiary because the carrier is paying them.”

4. Independent agents/broker

Independent licensed Medicare insurance agents/brokers can represent multiple insurance carriers. Given that, independent agents are typically able to offer clients a range of Medicare plan options. These agents work on commissions paid by the insurers and cannot charge a fee. According to the Commonwealth Fund, the Centers for Medicare & Medicaid Services sets maximum allowable commissions for Medicare Advantage and Part D plans that agents can earn. However, actual compensation varies by insurer within those limits.

Pros of working with independent agents

No cost: According to Maibor, there’s no cost to the Medicare beneficiary when buying Medicare coverage through an independent agent. Typically, the agent is paid by the health insurance company almost $600 to sell a Medicare Advantage plan and slightly more than $250 to sell a Medigap plan. Of note, the Centers for Medicare & Medicaid Services (CMS) sets the maximum broker commissions that can be paid for selling Medicare Advantage plans each year. For 2023, for instance, the maximum initial commission an agent can receive is $577 per Medicare Advantage plan sold. The maximum renewal commission is $288 per plan. There are no federally regulated maximum commissions for Medigap plans, according to the CMS. Insurers set their own commission rates. Typical first year commissions are around 20% of the plan’s annual premium. Renewal commissions are around 10%.

Wright said agents should not be reluctant to disclose their commissions.

Read: Agent Broker Compensation and Agent Commissions in Medicare and the Impact on Beneficiary Choice.

Wide selection: Independent agents typically represent a wide number of insurers/policies in any given area, typically at least several to dozens, Maibor said.

Trust: A trusted insurance professional with Medicare expertise is a valuable local resource who can help you evaluate your options. “The key is to make sure they are a “trusted insurance professional with Medicare expertise, said Wright. “That should ensure their recommendations are in your best interest and not theirs.”

This is a tall order since agents aren’t required, as, say, registered investment advisers are, to act in the client’s best interest, as fiduciaries. The best way to uncover whether you’re working with someone who is trustworthy is to ask them a series of questions aimed at uncovering whether they are acting in your best interest. (See graphic.)

Cons of working with independent agents

Conflicts of interest: An independent agent does not offer every plan in a given area “so (the agent) may choose a less appropriate plan to earn a commission,” said Maibor. That can often be the case given that agents earn more money when selling a Medicare Advantage plan versus a Medigap policy.

It’s the carrier that is paying the commission, not the Medicare beneficiary. Independent agents suggest the commission is ultimately modest. “Although commissioned, in reality the amount ‘per sale’ is very modest — unlike many life and annuity products,” Wright said. “Agents are rewarded by building up a stable long-term ‘block of business,’ not by making a few huge commission sales.”

What’s more, he noted that the market is closely regulated by Centers for Medicaid & Medicare “with very serious penalties for market conduct violations.”

Expertise: Independent agents, given that they might represent so many carriers, may not have comprehensive expertise on every individual plan “because they represent so many,” said Maibor.

5. Captive agents

Captive agents work for a single insurer and receive a salary from the company as well as a commission with a lower rate than an independent agent’s commission. They have in-depth knowledge of the products offered by the company they represent but are limited to plans from that particular insurer when assisting Medicare beneficiaries.

Pros of using a captive agent

Well versed/no cost: Captive agents and company representatives, not surprisingly, are well versed in a given carrier’s offerings. Plus, there’s no cost to the beneficiary when buying a plan from a captive or the company representative.

Cons of using a captive agent or company representative

Just one plan: A captive agent will only be able to offer plans from the carrier they work for whether that is the best option for the beneficiary.

Sales quota: Though regulated by the Centers for Medicare & Medicare, “there is genuine ‘pressure’ to make sales quotas for their company, which nullifies any genuine objectivity about which plan is best for the consumer,” said Wright.

6. Calling insurers directly

Beneficiaries can also call any number of insurers — UnitedHealthcare, Humana, Blue Cross Blue Shield, Aetna, Cigna, and Anthem to name but a few — and speak with a customer service rep.

Pros of calling insurers directly

No cost: A Medicare beneficiary pays no cost to purchase a plan directly from an insurer, said Maibor. Plus, there’s no agent to deal with.

Cons of calling insurers directly

Just one plan: The big downside to calling insurers directly is that they only offer their plan, which may or may not be the best option for the beneficiary.

Calling insurers directly can be a useful exercise when trying to sort through details of available coverage options for that specific health plan. “However, it does not offer a way to directly compare the pros and cons of competing plans,” said Wright. “The consumer would still have to make that evaluation for themselves after consulting multiple health plans directly.”

Other options

Pharmacies may be offering no-fee consultations regarding Medicare Part D plans.

The advantages are that it’s convenient. “It saves time because they already have your medication list,” she noted. The big disadvantage, Votava said, “is that it’s possible that they are incentivized to suggest plans that they have preferred status with.”

Check whether you’re getting the best price at a particular pharmacy. And if you have a Medicare Advantage plan, you will need to verify your healthcare providers’ plan participation separately, Votava said.

Bottom line

“I tell clients that this is an important decision and not an area where the cheapest source of advice is the best source,” said Maibor.

If they are already on Medicare, the beneficiary should ask the broker/adviser why they are suggesting that they change. “There may be absolutely valid reasons to make a switch but in many cases it is so the commission gets moved from where it is now to that broker,” said Maibor. “And that’s not a valid reason.”

One other note: Understanding the dual option choice of traditional Medicare vs Medicare Advantage is the key to understanding Medicare and its coverage choices, said Wright. “Unfortunately, 90% of advertising comes from Medicare Advantage plans because the Centers for Medicare & Medicaid Services do not ‘advertise’ traditional Medicare although agents sometimes will because they can sell the Medigap policies,” he said. “This results in a very lopsided public perception in favor of Medicare Advantage plans and contributes greatly to the confusion.”