The 60:40 portfolio is performing exactly as advertised.

I’m referring to the default allocation of many retirees’ and near-retirees’ portfolios, in which 60% is invested in the stock market and 40% in bonds. This portfolio was given up for dead last year, after it suffered one of its worst calendar-year losses in U.S. history. But, as expected, it has bounced back this year.

Furthermore, when viewed in its historical context, there’s no reason to expect its performance in coming years to be below average.

Through Oct. 18, a portfolio that was invested 60% in the Vanguard Total Stock Market Index ETF

VTI

and 40% in the Vanguard Long-Term Treasury Index Fund

VGLT

was up 2.9% year to date. On an annualized basis, that’s equal to a 3.8% gain, compared with the portfolio’s 23.5% loss in 2022.

The reason I say this bounceback was expected is not because of any market-timing judgment at the beginning of the year about the outlook for stocks and bonds. Instead, it was based on what’s known as “regression to the mean”—what my Wall Street Journal colleague Jason Zweig has referred to as “the most powerful force in financial physics.” Also known as “mean reversion,” regression to the mean implies that, following an extreme return (either positive or negative), the portfolio’s subsequent return is likely to be closer to its long-term average.

This has certainly been the case this year. The long-term average return for a yearly-rebalanced 60:40 portfolio is 7.1% annualized. (That’s according to data compiled by Edward McQuarrie of Santa Clara University.) This year’s 3.8% annualized year-to-date gain is a lot closer to that average than last year’s 23.5% loss.

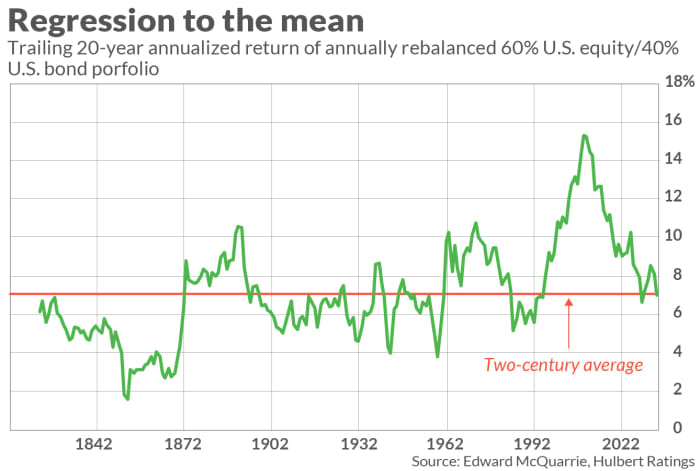

Furthermore, as you can see from the accompanying chart, the 60:40 portfolio’s trailing 20-year return is almost precisely equal to its long-term average. That’s important information to counter the argument from the portfolio’s detractors that it is coming off an extended period of well-above-average returns—and lower future returns are therefore to be expected. That argument carried more weight 15 years ago, when the portfolio’s trailing-20-year return was at a record high. But not any more.

Doing its job

Another way of appreciating the 60:40 portfolio’s potential is to think back three years ago, when interest rates were at record lows. How would you have positioned your portfolio had you known that interest rates would soon begin an almost-uninterrupted march to 16-year highs?

You would have avoided bonds, for sure, but you most likely would have reduced or eliminated your equity exposure as well. That’s because everyone “knows” that higher interest rates are bad for stocks. But here we are three years later, and despite higher rates the stock market is sitting on an annualized three-year gain of 7.9% (as judged by the Vanguard Total Stock Market Index ETF).

This equity return is far better than that of the alternative asset classes that you might have been tempted to invest in three years ago—such as gold bullion (which has produced a 0.5% annualized trailing 3-year return, as judged by the SPDR Gold Shares ETF

GLD

) and hedge funds (as judged by the 4.8% annualized return of the HFRI 400 U.S. Equity Hedge Index).

In other words, the 60:40 portfolio would have kept you heavily invested in one of the better-performing asset classes that you otherwise might have avoided.

Though there’s no guarantee, my bet is that the 60:40 portfolio will be an equally good bet in the event interest rates fall markedly in coming years. Everyone “knows” that a rate decline would be good for stocks, but historically it hasn’t always worked out that way. In the event stocks unexpectedly fall, a 60:40 portfolio would allow you to reduce your losses—if not eke out a gain.

The 60:40 portfolio is like an insurance policy that in most cases helps to cushion the losses from an equity bear market. When interest rates were so low three years ago, that portfolio carried little insurance. But with interest rates now at 16-year highs, the bond portion of the 60:40 portfolio represents significant potential to cushion equity losses.

Normally we would have had to pay a steep premium to acquire that insurance. But over the last three years that premium has been negative—the 60:40 portfolio has made money. We’ve been paid to acquire the insurance.

Giving up on the 60:40 portfolio now would be throwing away that insurance.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.