WeWork Inc. bonds have been sinking deeper into distressed territory after two top executives left the company on the heels of a complex debt restructuring.

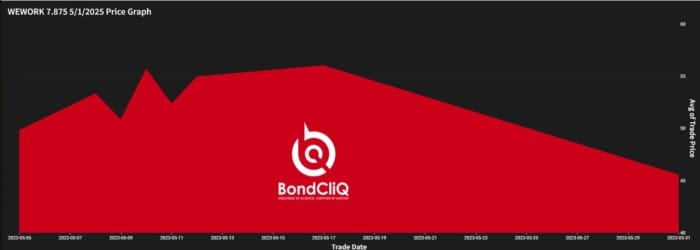

WeWork’s roughly $163 million of 7.875% bonds due May 2025 were trading hands at about 45 cents on the dollar on Thursday, down from about 55 cents in mid-May, according to BondCliQ data.

WeWork bonds owned by holdouts of a recent debt restructuring are trading deeper in distressed territory at about 45 cents on the dollar.

BondCliQ

Corporate bonds trading below 70 cents are broadly considered distressed.

WeWork bonds trading near 45 cents represent a small group of holdouts in a major recapitalization of the cash-burning company, which commenced in March and finalized in May.

The deal cut about $1.2 billion of its debt, provided about $290 million of immediate cash and significantly reshuffled WeWork’s debt load, according to CreditSights.

The holdouts’ claim on the company’s assets now sits below bondholders who opted to exchange old WeWork bonds for new ones in the restructuring. If the company were to tip into bankruptcy, the new bonds would be repaid first.

Since not all of the new bonds issued in May are trading yet, the holdout bonds may not paint a full picture of the performance of the company’s total package of debt.

A complex recap

A portion of WeWork’s creditors also added new money as part of the recapitalization, while receiving a higher coupon of about 15% (partially through interest and a payment-in-kind structure that adds to WeWork’s debt). The coupon is roughly double what the older bonds were paying through 2025, according to CreditSights.

In addition to pushing out WeWork’s overall maturities, the May recapitalization gave participants a chance to equitize some of their old debt.

“It was an outrageously complex transaction,” said Evan DuFaux, a special situations analyst at CreditSights. But he also called it “effectively a prepackaged bankruptcy, with senior creditors taking control of the company from SoftBank.”

That isn’t how WeWork sees it. “The debt transaction announced in March strengthened WeWork’s balance sheet, reduced total debt, and enhanced its liquidity with over $1 billion in new funding and new and rolled capital commitments,” a spokeswoman told MarketWatch in a written statement.

“As we have said as recently as earnings on May 9, WeWork is focused on executing its business plan and any suggestion otherwise is categorically false.”

Stock falls to 17 cents

Office properties have been in the eye of a commercial real estate slump, with some seeing positives and negatives for co-working companies if corporations shrink their permanent office footprint, but flock to flexible alternatives.

WeWork’s stock

WE,

has fallen 88.3% on the year through Thursday, when it closed at 17 cents, according to FactSet. The New York Stock Exchange on April 11 warned WeWork it was in danger of a delisting, after shares had traded below $1 for more than 30 sessions in a row. On its first day of trading after going public via a merger with a special-purpose acquisition vehicle, or SPAC, on Oct. 21, 2021, it closed at $11.78.

Given that WeWork burned through about $350 million in cash in the first quarter, DuFaux at CreditSights estimated that the May recapitalization only bought the company an additional quarter or two of runway.

That assumes the company’s cash burn stays the same. WeWork’s former CEO said in a recent earnings call that he expected it to decrease, and turn positive by the end of this year.

At its peak, WeWork was valued at $47 billion. CreditSights pegged its current value at about $1 billion, meaning its equity lost about 99%.

CEO, CFO exit

After news in mid-May emerged of real estate veteran Sandeep Mathrani stepping down as CEO on May 26, WeWork’s stock tumbled to a fresh low of 26 cents. David Tolley, a board member, was named interim CEO.

Mathrani took the helm of WeWork in February 2020, giving investors a shot of confidence in the company after co-founder Adam Neumann was ousted in 2019, following a bungled IPO planned for that fall.

About a week after news of Mathrani’s departure, WeWork said Chief Financial Officer Andre Fernandez was resigning, effective June 1. The board appointed Kurt Wehner, its chief accounting officer, as CFO and treasurer.

“The two departures occurred as the company continues to struggle,” a Barclays credit research team led by Lea Overby wrote in a Thursday client note.

Overby’s team focused on an estimated $7.5 billion of exposure that investors in the commercial mortgage-backed securities market have to the company.

“In 2018, the company announced that it had become the biggest private office tenant in Manhattan. Given the current weak fundamentals of the office market in New York, we believe these locations might be at particular risk of closure due to overconcentration,” the Barclays team said.

Read: A default wave is building, says Deutsche Bank. Here’s how bad it may get.

—Ciara Linnane contributed reporting to this article