A new Federal Reserve paper indicates policy makers have a different take on financial conditions than widely assumed. That’s a big deal for stock-market investors, said economists at Evercore ISI, in a Wednesday note.

The paper published on June 30 with the title, “A New Index to Measure U.S. Financial Conditions,” proposes a new index that can be used to gauge broad financial conditions and assess how they relate to future economic growth. The index is “broadly consistent” with the Federal Reserve Board’s economic model, the paper’s authors said.

Read the Fed paper here.

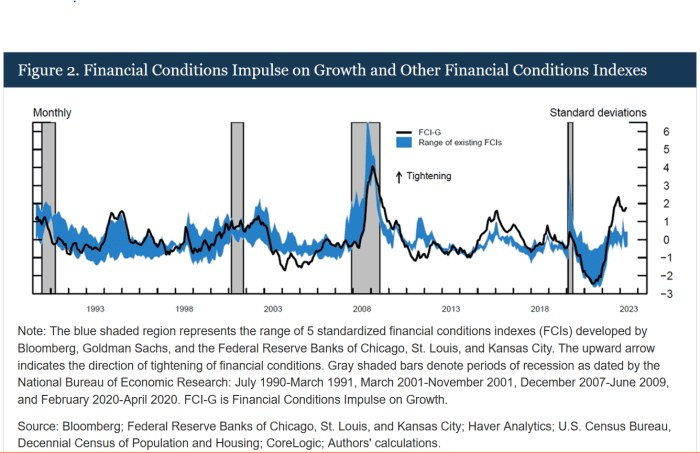

The interesting part for investors is that the new index shows financial conditions are much tighter than closely watched indexes produced by Goldman Sachs, Bloomberg, and a handful of regional Fed banks, noted Evercore ISI economists Krishna Guha and Marco Casiraghi. And while conditions have moderated somewhat in recent months, they remain very tight by historic standards and tighter than at any period since the Great Financial Crisis of 2008, Guha and Casiraghi wrote (see chart below).

Board of Governors of the Federal Reserve System

The Fed paper describes “financial conditions” as a “somewhat vague economic concept” that typically refers to a constellation of asset prices and interest rates that are influenced by a variety of factors — including monetary policy — and have the potential to affect the real economy.

“Because of the ambiguous definition, measuring financial conditions is challenging,” the Fed researchers wrote.

The new index might clear up some confusion over what exactly Fed policy makers are referring to when they talk about financial conditions. Investors were left confused earlier this year when Fed Chair Jerome Powell told reporters that financial conditions had tightened significantly over the past year, notwithstanding what had been some recent easing.

Some market watchers had expected more concern from Powell, given past griping that easing conditions undercut the Fed’s inflation-fighting efforts. Indeed, Powell’s earlier remarks had led some market watchers to warn that big stock-market gains would spark more aggressive Fed interest hikes.

U.S. stocks have rallied in 2023 as the Fed has slowed the pace of interest rate increases, opting last month to leave the fed-funds rate unchanged but indicating that further increases remained in store. The S&P 500

SPX,

has rallied around 16% so far this year, exiting a bear market, in a technology sector led rally that’s seen the Nasdaq Composite

COMP,

jump more than 30% while the Dow Jones Industrial Average

DJIA,

has lagged behind, up 3.5%.

“The paper confirms something we have been arguing for a long time — that when Powell and other Fed policy makers talk about financial conditions they mean something very different from the Goldman Sachs FCI (financial conditions index) or other widely available FCIs including the Bloomberg FCI and FCIs published by the Chicago, Kansas City, and St. Louis Feds,” the Evercore economists wrote.

In particular the Fed puts more weight on a variety of interest rates, incorporating mortgage rates and corporate credit yields, and less weight on the level of the stock market than the index produced by Goldman Sachs, they said.

Also, the Fed is concerned with the lagged effects of earlier financial conditions on future activity as well as the impact of current spot financial conditions on future activity, the Evercore economists said. The falling away of residual fiscal and monetary stimulus from ultra-easy conditions in 2021 and the continued impact from the Fed’s rapid monetary tightening in 2022 should continue to weigh on growth.

Given these lags and the weight put on short-term and, in particular, long-term interest rates, the Fed should be relatively tolerant of stock-market gains that have a relatively modest impact on the new index and the outlook for activity, Guha and Casiraghi said.

“In other words, the Fed is less likely to oppose the stock market rally — unless it gets completely out of hand — than widely feared,” they wrote.