The quarterly corporate earnings reporting season is typically a happy time for the U.S. stock market, but this summer might be different, analysts say.

Instead of being a buying opportunity, the next four weeks could prove to be a “sell the news event” for stocks, according to Nadia Lovell, senior U.S. equity analyst at UBS Global Wealth Management.

If that happens, it would make this earnings season unusual relative to recent history. Over the past couple of decades, U.S. stocks have typically accumulated an outsize percentage of their annual gains during the four weeks where the bulk of the largest U.S.-traded companies share their results.

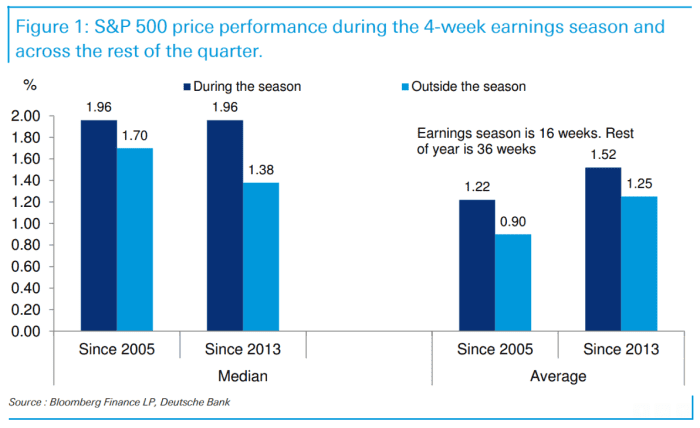

A Deutsche Bank analysis found that the S&P 500 index has logged a median quarterly gain of roughly 2% during the four-week peak of earnings season. By comparison, stocks have seen a median gain of 1.7% for the remainder of the quarter.

“This is a huge disparity given that earnings season accounts for 16 weeks of the year (30.7%) with the rest of the year making up 36 weeks (69.3%),” said Deutsche Bank’s Jim Reid in commentary shared with MarketWatch on Friday.

DEUTSCHE BANK

But even Reid acknowledged that this earnings season might depart from this historical pattern, given the force of the rally that is already taken place as institutional investors have shed their wariness and bought back in to the market.

Others raised similar doubts.

“More likely than not, the market has run ahead of the fundamentals. The buy side has factored in a better outlook for companies, but price-to-earnings multiples are looking rich,” UBS’s Lovell said during a phone interview with MarketWatch.

S&P 500 firms are expected to report a 7.1% decline in earnings compared with the same quarter last year, according to the latest blended estimate from FactSet that incorporates results from firms that have already reported.

If that number holds, it will mark the biggest year-over-year decline since the second quarter of 2020, when the advent of the COVID-19 pandemic caused profits to collapse by 31.6%. It was also mark the third consecutive quarter where earnings were lower than a year earlier.

At the same time, S&P 500 firms are presently being valued at more than 19 times forward earnings. That is above the five-year average of 18.6, and the 10-year average of 17.4.

Lovell added that stock valuations are looking “rich,” which means earnings will need to outperform Wall Street’s typically conservative estimates by an even wider margin than usual to keep the rally going.

Shares of some of the biggest U.S. banks including JPMorgan Chase & Co.

JPM,

Wells Fargo & Co.

WFC,

and Citigroup Inc.

C,

rose on Friday after reporting earnings ahead of the market open. But heading into the close, their shares had reversed most, if not all, of these gains.

According to Lovell, this dynamic could become a staple of the market’s reaction to earnings reports released during the coming weeks.

The S&P 500

SPX,

dipped into the red Friday afternoon, and is on track to finish the session down 0.1% at 4,507. Still, the index logged its highest close since April 5, 2022 on Thursday, and will mark a fresh 15-month high if it manages to close in the green on Friday. It has risen 17.4% so far this year, according to FactSet data, having reversed much of its 19.4% decline from 2022.