Retirees and near-retirees probably don’t know it, but target-date funds are turning them into contrarians.

Target-date funds (TDFs), of course, are mutual funds whose sponsors believe them to be “buy them and forget them” solutions to investing for retirement. Their equity allocations algorithmically decline as retirement age gets closer, while their bond allocations simultaneously increase.

One underappreciated consequence of how TDFs are managed is that they sell stocks as the market soars and buy when it is plummeting. That is just the opposite of how most of us, when left to our own devices, would act. As behavioral economists tell us, our psychological inclination is to chase returns rather than bet against them. This trend-following behavior is at the opposite end of the spectrum from TDFs’ contrarian strategy.

Until recently, TDFs’ possible market impact wasn’t even potentially an issue. Less than $8 billion was invested in TDFs and similar funds in 2000, for example. But today there is an estimated $5 trillion invested in TDFs, and they are now the 800-pound gorilla of the retirement investment world. A new study finds that they are having profound impacts on the behavior of the overall market.

A study titled “Target Date Funds As Asset Market Stabilizers: Evidence From the Pandemic,” was conducted by Jonathan Parker of MIT and Yang Sun of Brandeis University. They found that, as TDFs have grown in size over the last two decades, the stock market has become less volatile than it would have been otherwise.

You may find this hard to believe, given the market’s recent volatility. Few of us can forget the market’s waterfall decline in the immediate wake of the COVID-19 economic lockdowns in early 2020, during which the S&P 500

SPX

lost 34% in just 33 calendar trading days. But the researchers argue that it would have been worse if it were not for TDFs.

The researchers estimate that, by buying stocks during that waterfall decline, TDFs offset 19% of the outflows from equity funds. They further estimate that this offset reduced the magnitude of the market’s decline by about a tenth. This may strike you as an unambiguously Good Thing, of course, but don’t forget that just the reverse will be the case when the stock market shoots up. In that event, TDFs will offset some of the new cash that would otherwise flow into equity funds, and thereby dampen the market rally that would otherwise have occurred.

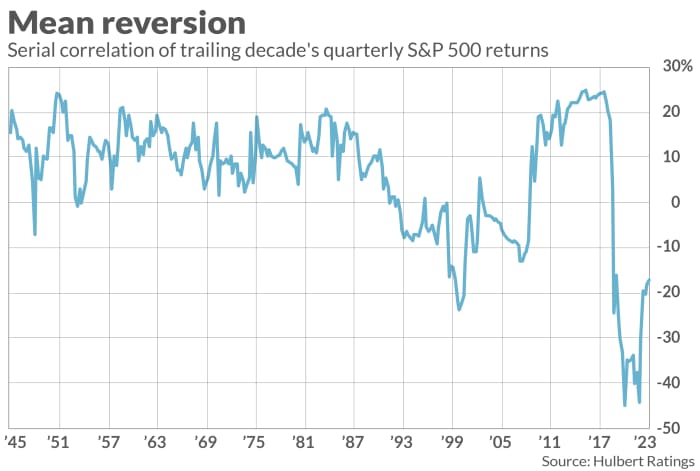

The accompanying chart illustrates what’s happened as TDFs and similar funds have become so dominant. The chart measures the extent to which the S&P 500’s return in a given quarter is in the same direction as it was in the immediately prior quarter. The specific statistic the chart plots is the correlation coefficient measured over the trailing 10 years, with a positive coefficient indicating that a given quarter’s market direction is more often not the same as it was in the prior quarter. Notice that this statistic has turned dramatically negative in the last couple of years.

To be sure, Parker pointed out in an email, TDFs are not the only source of this downturn.

“This change is surely partly due to TDFs, but also surely not only TDFs. The other effects in play are the increase in other asset management tools that act in ways that are similar to TDFs and rebalance out of stocks when they do well and into stocks when they do poorly, from robo-advisory programs to managed portfolio products, to endowments and other large investors that rebalance across asset classes.”

Will retirees and near-retirees perform better in the future because they are now closet contrarians? That’s difficult to answer. Though contrarian approaches over the long term have outperformed trend-following strategies, much of their outperformance can be traced to how few were truly contrarian.

When the vast majority of investors are chasing returns, the market is more likely to become extremely over- or under-valued—the very preconditions for contrarian strategies to be profitable. As more investors become contrarian, it may very well be that the approach will become less profitable—and, ironically, trend-following approaches will become more profitable.

The more important investment takeaway is that you should be aware of how TDFs react to big market moves, either up or down. If you don’t want to be a contrarian, for example, then you may not want to invest your 401(k) or IRA in a target-date fund.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.