Visa Inc. called out resilient spending as it logged an earnings beat for the latest quarter, but its shares were still coming under pressure in Thursday’s after-market action.

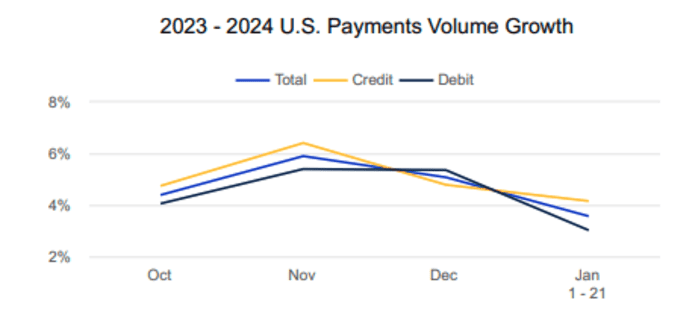

The culprit? A slowdown in U.S. volumes into January, according to analysts.

Mizuho analyst Dan Dolev noted that Visa’s

V,

U.S. payment volumes decelerated in the fiscal first quarter and in the first three weeks of January, a trend driven by debit transactions.

Visa

Baird analyst David Kallo said that while the deceleration in January U.S. volumes and total processed transactions was “not a huge surprise,” those trends could cause the stock to “pull back mildly tomorrow.”

Visa Chief Financial Officer Chris Suh said the January U.S. trends reflected one-off factors that weren’t indicative of broader spending issues. For example, areas like Kansas City and Dallas have seen extreme cold temperatures that have prevented people from going out and spending.

“We’ve seen weather-related patterns before,” he said. “It doesn’t give us major concern.”

As for the December-quarter volume trends, he said the slowdown was a matter of timing.

“Putting it all together, the step-down of about 80 basis points in total U.S. payments volume growth from Q4 to Q1 was primarily due to a less favorable mix of weekends and weekdays,” he said on Visa’s earnings call.

“Consumer spend across all segments from low to high spend has remained relatively stable,” he continued. “Our data does not indicate any meaningful behavior change across consumer segments.”

Investors, though, still seemed concerned, and shares fell nearly 3% in after-hours trading Thursday.

See also: PayPal CEO sees ‘huge monetization opportunity’ after revamp, but stock drops

For the fiscal first quarter, Visa posted net income of $4.9 billion, or $2.39 a share, compared with net income of $4.2 billion, or $1.99 a share, in the year-prior period. After adjustments, Visa earned $2.41 a share, beating the FactSet consensus view, which was for $2.34 a share.

Revenue rose to $8.63 billion from $7.94 billion, whereas analysts had been looking for $8.56 billion.

The company saw an 8% boost in payments volume during the latest quarter, while processed transactions rose by 9%.

Consumer spending has been “resilient” and “quite stable,” Suh said.

The company saw a 16% boost in volume from cross-border transactions, which take place when someone makes a purchase from a merchant based in a different country. Cross-border volume typically is seen as a proxy for international travel, though it also encompasses international e-commerce purchases.

“Travel contunues to be a tailwind” and is “quite healthy,” Suh told MarketWatch.

For the fiscal second quarter, Visa expects net revenue to grow at an “upper-mid” to high-single-digit rate. The company also expects earnings per share to grow at a “high-teens” pace from a year before.

The company is sticking with its full-year forecast, which calls for low-double-digit revenue growth on an adjusted constant-dollar basis.

Fiscal 2024 could be “a little bit of a mirror image of 2023 in the sense that our first-half revenue growth rate, even if the fundamentals are very stable…will be compressed just because of the high comparables a year ago, and we see lots of reasons why the second-half-of-the-year growth rates will accelerate,” Suh told MarketWatch.

The company faces easier comparisons in the second half of the year, he said, and management expects to see favorable trends in average ticket sizes.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching — and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.