This holiday season has so far been pretty consistent in giving investors exactly the gift they want — a “Santa Claus rally” that could bring record highs for U.S. stocks, with Wall Street on pace to close out 2023 with strong gains.

The term refers to a phenomenon where the stock market closes higher for the last five trading days of the current year and the first three trading days of the new year. This year’s Santa Claus rally period officially kicked off Friday, and has seen the S&P 500

SPX

rise 0.6% over the past two trading days, while the Nasdaq Composite

COMP

has climbed 0.7% and the Dow Jones Industrial Average

DJIA

remained nearly flat over the same period, according to FactSet data.

However, data indicate that a strong Santa period often leads to a tough January, according to Andrew Greenebaum, senior vice president of equity research product management at Jefferies.

“In the same way that filling up at a much-anticipated holiday meal can often leave you feeling uneasy and a bit overindulgent, too much of a December rally looks like it might pull from January returns,” he said in a Saturday client note.

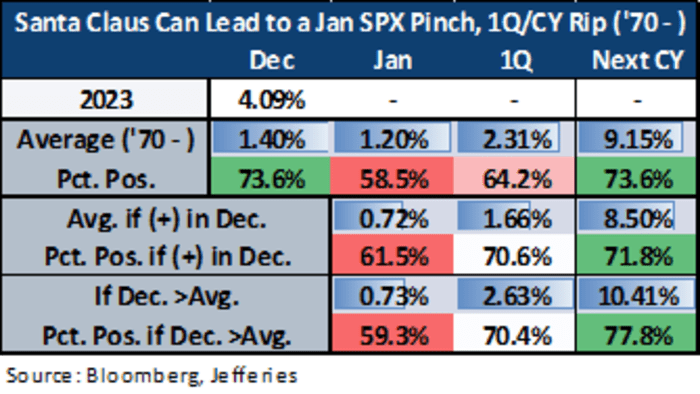

Dating back to 1970, the average performance of the S&P 500 in December has brought gains of 1.4%. While January is not exactly “shabby,” with a monthly average gain of 1.2%, the advance gets nearly halved when December is positive or even above average, according to data compiled by Jefferies (see table below).

Source: Bloomberg, Jefferies

“January — call it a pull forward — tends to see worse-than-typical returns, and in general, the month has a higher chance of negative S&P 500 price action,” Greenebaum said.

However, there are still some positives to keep in mind, the analyst added. Despite the more-frequently negative January that comes after a strong December, the S&P 500’s returns for the following calendar year tend to be around 1% higher than average when the prior December records a better-than-average advance, Greenebaum said. The calendar year also ends up with positive returns nearly 80% of the time, he added.

See: S&P 500 is moving toward record territory. Here’s what stock-market investors need to know.

U.S. stocks finished higher on Tuesday to kick off the final trading week of the year. The S&P 500 was up 0.4%, to end at 4,774, while the Dow Jones Industrial Average edged up 0.4%, at 37,545, and the Nasdaq Composite jumped 0.5%, to finish at 15,074, according to FactSet data.